Saving Funds in Cyprus

1.The Categories of the Funds

1.The Categories of the Funds

Savings funds in Cyprus can be classifed into three categories according to the level of risk they entail:

- Conservative - Low-risk funds

- Moderate - Medium-risk funds

- Aggressive - High-risk funds

1.1. Low-Risk Funds

Low-Risk Funds are the most popular option in Cyprus, since they mostly invest on saving or investment products that carry low investment risk, such as cash funds, certificates of deposits, government bonds of western economies (>AA+) and corporate bonds from big companies (blue chips).

Low-risk products like cash funds, certificates of deposits and bonds provide a predictable income stream (interest, coupons).

The value of these investment unit funds usually fluctuates within the range of 5% (+/-) annually.

Low-risk funds are usually selected by investors who avoid risk and who are not interested in high returns.

Employing a conservative savings policy, these funds ensure that the planholder will get the sum they planned for at the end of their contract.

Historical data show that these funds carry lower risk than certificates of deposits of banks with credit rating lower than an A, based on Standard and Poor’s credit rating system.

In 2013, the ‘haircut’ on deposits higher than 100,000 euro in Cyprus first introduced the idea of a ‘bail-in’, namely the concept that in case of an inability to pay off its debt, a country’s government can actually confiscate the capital of its depositors.

Low-risk funds, as opposed to bank deposits, are extensively diversified, since they split the investors’ money into savings products in a number of developed countries. As a result, the investor is not exposed to any risk arising from the bankruptcy of an individual bank or country.

1.2. Medium-Risk Funds

Medium-risk funds invest in corporate bonds, government bonds, Real Estate Investment Trusts (REITs), and the stocks of large international companies whose value has historically proven to have a low fluctuation rate.

It has been observed that the rates of medium-risk funds do not fluctuate over 10% annually apart from some extreme-case scenarios.

This type of funds is made for investors who are willing to take a slightly higher risk in order to obtain a more satisfying return within the framework of their general investment policy.

Medium-risk funds should be avoided when an economic recession is expected to happen.

1.3. High-Risk Funds

Finally, high-risk funds, or dynamic/aggressive funds as they’re otherwise known, are the ones whose return does not fluctuate significantly beyond 15% (+/-) annually. This, of course, also depends on the kind of products they invest in, as well as the markets they choose (countries and industries).

These funds mostly invest in stocks, corporate bonds and, in some cases, government bonds of developing economies (e.g. BRICS). Their large range of investments is the reason why they are called mixed investment funds.

To ensure a high yield, mid-cap companies with a high profitability and development prospects are selected.

High-risk funds have a higher management cost, since their managers continually buy and sell financial products in order to find the ones with a better performance rate within the constantly-changing financial and political circumstances around the world.

This type of a investment fund is suggested mostly to people of a young age with an investment horizon beyond 20 years, since it is expected that within their contract duration, the financial cycle will mend itself even if it starts off with a negative return.

The Insurance Companies Control Service in Cyprus do not allow for aggressive funds of insurance companies to invest in alternative financial products such as options, futures, forwards, CFDs and forex, since they are considered to be very high-risk.

Mixed investment funds are supported by the biggest capital fund managers such as Ray Dalio, as they assert that in the long-run, financial markets tend to follow an upward trend due to the improvement of technology and means of production, and there is therefore no need for money to remain ‘stagnant’ by being tied up in certificates of deposits or bonds.

2.The Presentation of Funds

The Superintendent of insurance companies in Cyprus sets certain guidelines as to how the expected returns of the funds are presented.

To be more specific, presentation tables have to contain a yield of 1%, 3.75% and 6.5%.

These three numbers are simply the most pessimistic scenarios regarding the yield of conservative, moderate and aggressive funds.

The average yield for the three types of funds in the last 20 years was significantly higher, with 3.1%, 6.3% and 8.5% respectively.

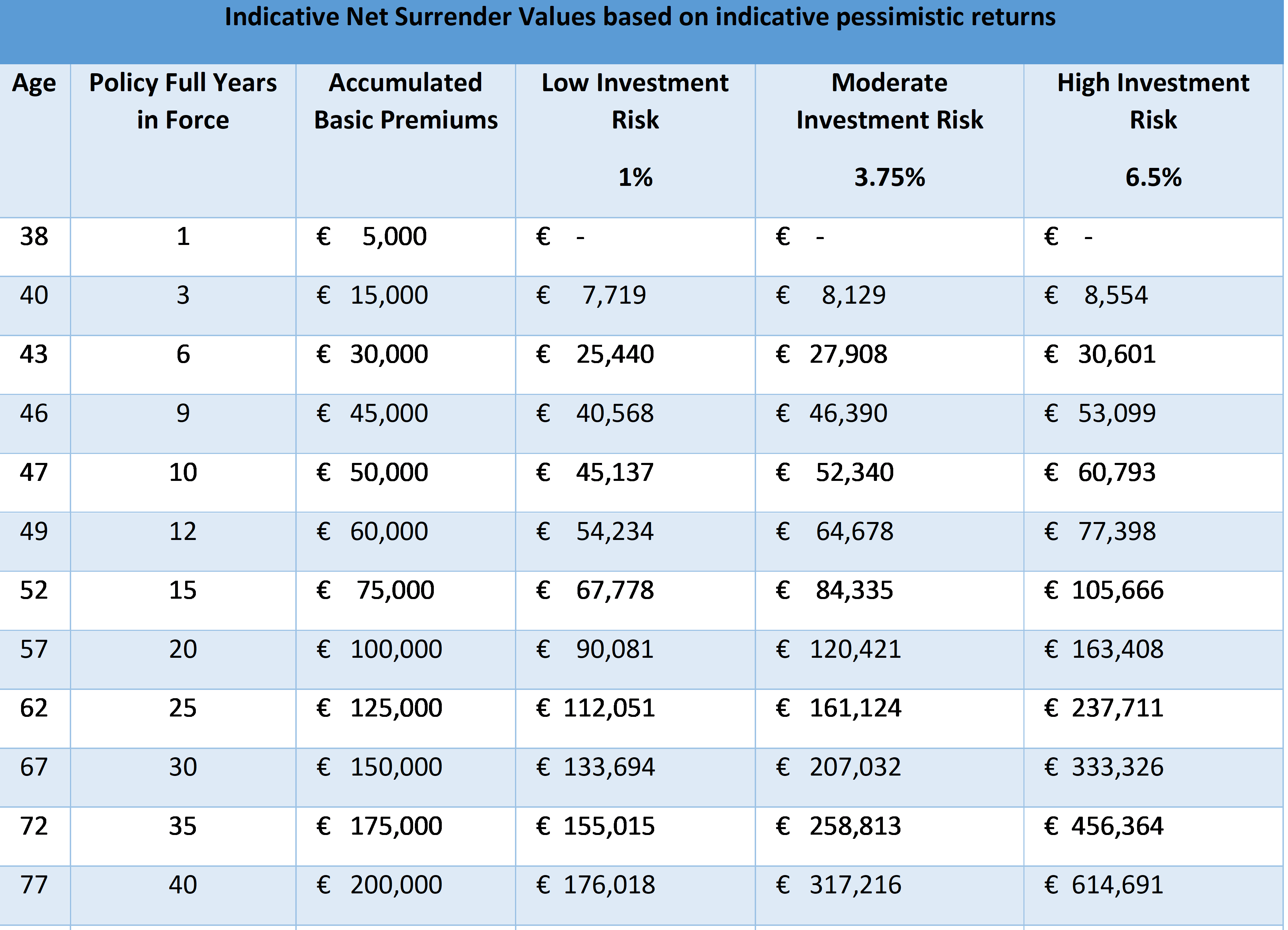

Table 1 below shows the redemption value based on the most pessimistic scenarios for each fund. This scenario concerns a 37-year-old with an annual income of 55,920 euro, who wants to annually invest a sum of 5,000 euro (which is also the sum guaranteeing him the maximum tax deduction).

Table 1 - Indicative Fund Yield

If we take into account the extremest scenario of a 1% average yield for the next 40 years, we can see that at no point does the insured's contribution exceed the contract’s redemption value.

If we take into account the extremest scenario of a 1% average yield for the next 40 years, we can see that at no point does the insured's contribution exceed the contract’s redemption value.

As we will consequently illustrate, however, savings insurance remains particularly profitable even under such extreme circumstances.

Before doing so though, we should explain why contributions are higher than the contract’s redemption value during the first 5 years, even for the yield rates of 3.75% and 6.5%.

This happens for the following reasons:

● Part of the fund is tied up during the first decade to ensure the longevity of the contract. This amount is not reflected in the redemption value.

● Part of the contributions are considered irrecoverable funds that are spent toward the cost of life insurance. Without that, the savings insurance contract cannot be used for a tax exemption (for more, see article on how tax exemptions are calculated with the use of a tax calculator).

● During the first year, part of the contributions is used as an insurance fee for the company managing the contract.

If the insured is to get the whole picture as to how savings insurance can benefit them, they should also calculate the money saved by tax deductions every year.

For example, in the 9th year of the contract, the insured’s contributions are 45,000 euro, whereas the contract’s redemption value under the most pessimistic scenario is €40,568. However, there has been a steady tax deduction of €1,500 per year during that time (this amount can be calculated using the tax calculator). Therefore, the total tax deduction for all 9 years is:

9 x €1,500 = €13,500.

So on the 9th year, the investor’s total funds can be calculated by adding the annual tax deduction to the redemption value as such:

Total funds = Redemption Value + Tax deduction (9 years)

Total funds = €40,568 + €13,500 = €54,068.

So as can be seen on the table, redemption values vastly go up over time, since this is a long-term contract and its real advantages can truly be realised after at least 20 years.

3. Pitsas Insurances Funds

3.1. The funds’ saving strategy

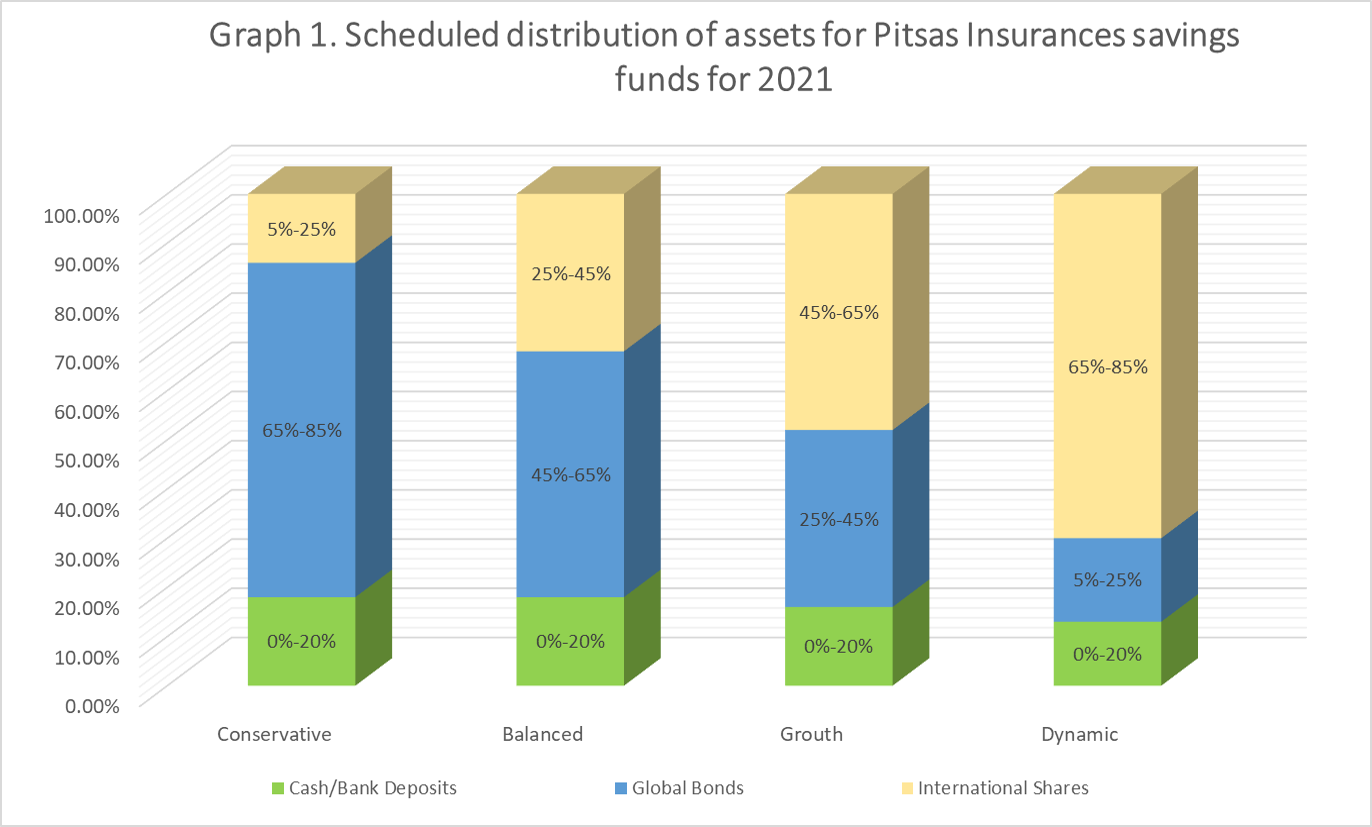

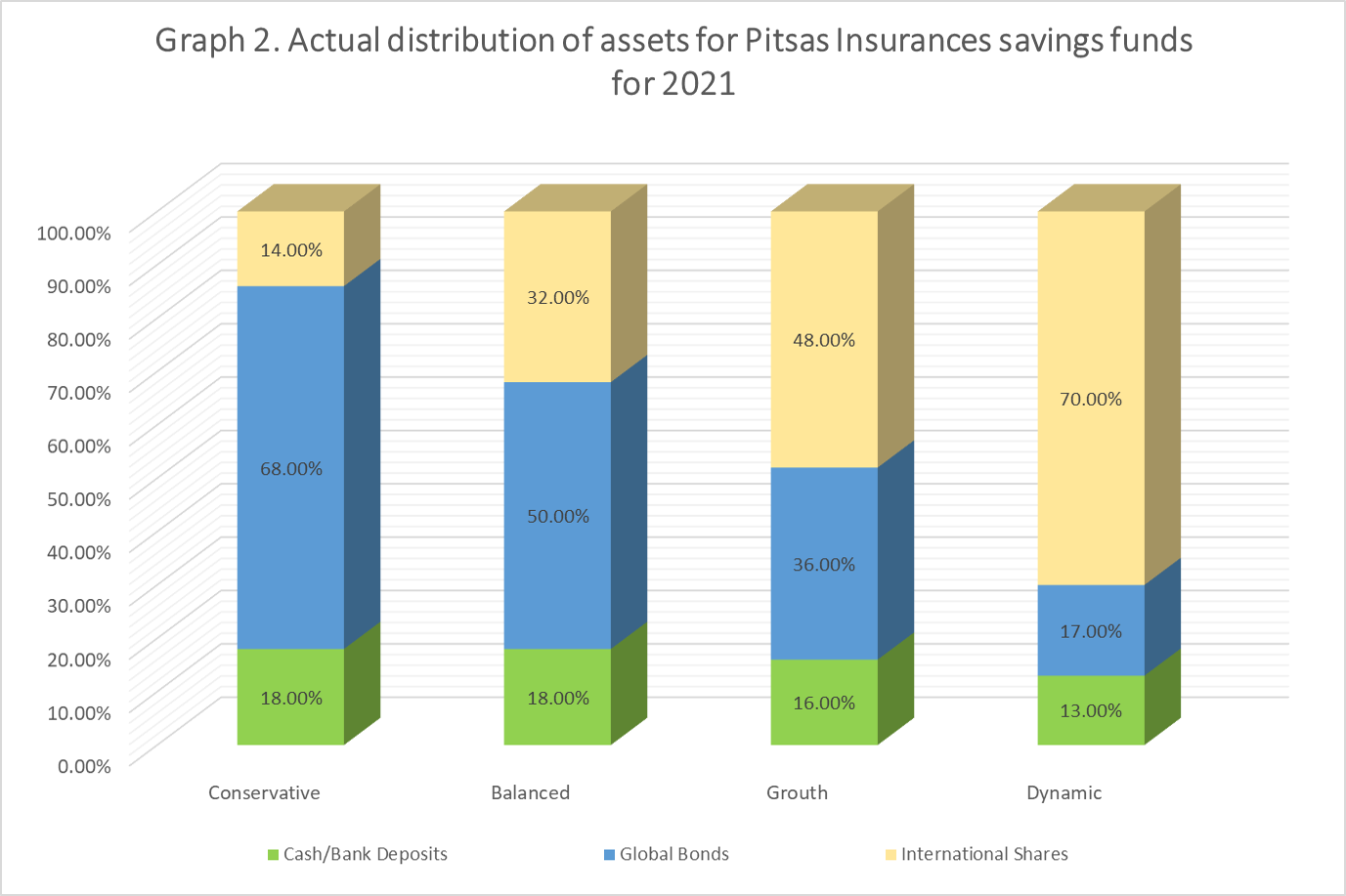

In order to better visualise the funds’ strategy, we will focus on the four main funds Pitsas Insurances offers through the biggest fund managers in the world, Pimco and The Vanguard Group.

Graph 1 shows the predetermined fund policy for 2021, while Graph 2 shows the actual composition of the fund, as it was by the end of 2021.

Balanced and Growth funds are subcategories of moderate funds.

As can be seen, the actual distribution is slightly different than the scheduled one.

As can be seen, the actual distribution is slightly different than the scheduled one.

This either happens to effectively deal with certain technical difficulties or because the managers of the funds need to be able to take advantage of unexpected investment opportunities or avoid financial risks.

3.2. The yield rates of Pitsas Insurances funds

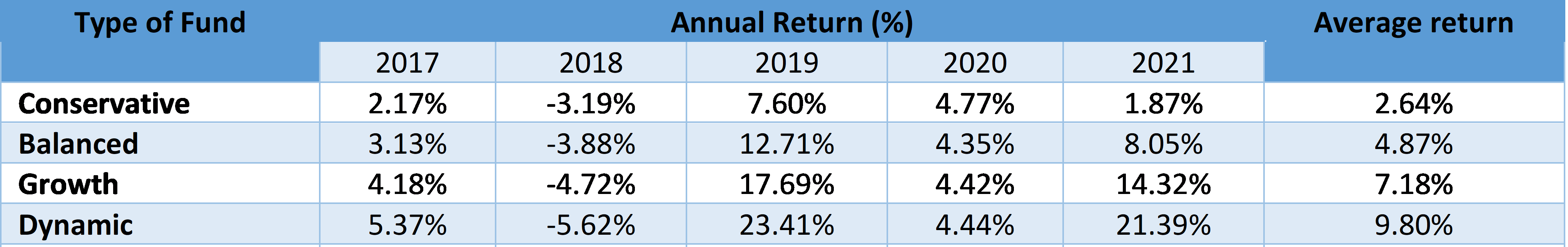

Table 2 shows the yield rates of Pitsas Insurances’ four savings funds.

Table 2 - Annual fund yields

As can be seen from the table, the highest-risk funds (namely the ones that invest in stocks) have a higher yield in times of economic prosperity but an equally sizable reduction in times of recession.

As can be seen from the table, the highest-risk funds (namely the ones that invest in stocks) have a higher yield in times of economic prosperity but an equally sizable reduction in times of recession.

4. Which type of fund should I choose?

In order to make the right choice of fund for you, you should do so under the guidance of a licensed insurance or investment advisor.

The advisor will assist the investor with determining what their financial goals and budget constraints are.

The most usual goals are retirement, higher education for their offspring, gathering sufficient money to purchase some property, creation of a "rainy day" fund and decreasing taxable income.

When it comes to the first two, the insured should be clear as to the desired amount they wish to receive, as well as the duration after which they wish to have access to their funds.

5. Should I choose an international or Cypriot insurance company?

In Cyprus, only insurance companies have the licence to offer savings products eligible for a tax exemption. These companies are split into two categories - Cypriot companies and international ones.

International insurance companies based in Cyprus are essentially branches of big international insurance companies from the USA, Germany and Switzerland.

Local insurance companies belong to Cypriot beneficiaries and simply collaborate with international insurance companies. They essentially function as intermediaries between their clients and international insurance companies. This is also the reason why their contract management fees are significantly higher than those of international companies.

Regardless of being local or international, an insurance company is not allowed to make investments.

All insurance companies hand over their clients’ money to investment banks (JP Morgan Chase, Morgan Stanley, UBS etc.) or to investment firms (Pimco, The Vanguard Group, BlackRock etc.), which then handle their management. Insurance companies are simply responsible for gathering the minimum amount of capital so they can participate in these funds.

So even if an insurance company in Cyprus goes bankrupt, its investors’ money is secure since the investment funds are in the hands of these large investment organisations.

International insurance companies have the following advantages compared to local ones:

- Lower management expenses.

- Greater degree of transparency when it comes to their funds investment and charging policies.

- Higher solvency ratio. Particularly low probability of freezing assets.

- They avoid Cypriot banks for deposits due to their low credit score.

- Greater sense of security. International companies are not regulated just by the superintendent of insurance in Cyprus but also by international regulators.

6. Who manages Pitsas Insurances’ Investment Funds

Pitsas Insurances is the official representative exclusively of international insurance companies.

Our clients’ investment funds are managed by the biggest investment companies in the world, Pimco and The Vanguard Group.

PIMCO is the biggest manager of sovereign and corporate bonds globally, actively managing assets worth $1.7 trillion (March 2022).

The Vanguard Group is the biggest manager of mutual funds worldwide, managing assets valued at 7.1 trillion dollars (January 2022).

Director Pitsas Insurances

June 2022

Limassol, Cyprus