Road tax Cyprus 2025. How to renew your road tax

ROAD TAX CYPRUS 2022

Road (transport) tax is calculated depending on the volume (CC) of the engine, the weight of the vehicle, the type of fuel it uses, it's age and the volume of emissions of harmful substances into the environment. The proof of payment of tax is a road license, which indicates the date of its issue and the month of expiry (see the photo below).

How to renew your road tax:

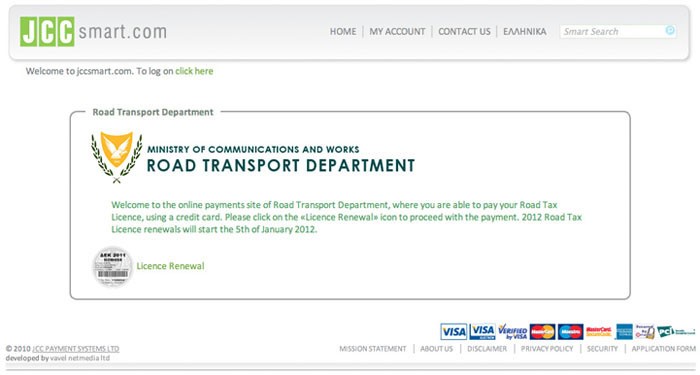

Circulation License (or road tax) can be renewed throughout the year online, at banks, citizen service centers, district post offices, as well as at the district offices of the Road Transport Department of the Ministry of Transport of Cyprus.

What you need to know and have with you to pay road tax

To pay your road tax online you will need:

- Your Vehicle Registration Certificate (Log Book)

- An email address

- A Debit or Credit card

- An Insurance Certificate or a Cover Note

Click here to open the page of the Road Transport Department in a separate window.

Follow the on-screen steps to set up an account on the site, then enter the car's registration, the owner's reference number and the desired period of cover.

Put your card details, make the payment and either print the road tax or save it to a device.

The owner's reference number is the last three digits of their identity card, Alien Card, or passport shown on the vehicle's datasheet under capital letters I.C. No. or [C.9].

Cases when it is impossible to renew road tax

In the event that your MOT (technical inspection) has expired, you won't be able to renew your road tax. The details of your vehicle's MOT are entered into the Road Transport Department's database, and if it has expired, the road tax is considered invalid regardless of it's expiry date; in this case, during an inspection, you will be held liable for both violations. You can find out more about MOT in Cyprus here.

Terms and procedure for payment of road tax. Responsibility for non-payment of the tax

Road tax is paid annually from the beginning of January to March 11 without any penalties. After the expiry of the specified period, a penalty of € 10 plus 10% of the tax amount is charged to the amount of road tax. If the tax is not paid during the whole year, additional sanctions will be applied. You can pay road tax both for the whole year, half a year and a quarter year. When paying tax for half a year, you should be careful not to miss the next tax payment deadline. Usually the state gives about two months to pay tax for the next period. So, if your Circulation License expires on June 30, you can pay tax for the next six months from July 1 to September 8 of the current year. It should be kept in mind that with a six month tax payment, the total tax amount for the year will increase by about 10% compared to the tax amount paid for the entire year at a time.

If your vehicle is not in use

If you do not intend to use your vehicle - for example, you will be abroad for a longer period of time - you can apply for a refund of the part of the road tax corresponding to the period of your absence at the next payment. In the event that the vehicle is scrapped so that you no longer have to pay road tax, a TOM98A statement and a Certificate must be submitted to the Road Transport Department.

What should you do with your vehicle when traveling abroad?

In case you are going to leave Cyprus for an extended period of time, you need to contact the Road Transport Department or the Citizen Service Center and fill in TOM12B form.

In this form you must indicate the place where your vehicle will be located during your absence in order to conduct an inspection. Subject to the above procedure, the amount of transport tax due for the period of your absence will be returned to you by the state.

Road tax rates in Cyprus

Road tax rates are constantly updated and depend on the age of the car and the date of its first registration in Cyprus. The following road tax rates are currently in force:

Road tax rates for the vehicles registered prior to January 1, 2014

The rates below apply to most private vehicles and are for a period of 12 months. The Road Transport Department provides an opportunity to pay road tax for half a year or even a 3 month period. At the same time, the amount of road tax paid for half a year corresponds to half of the annual amount of road tax with a slight surcharge, as is also the case with the 3 month road tax.

Table 1. Road tax rates applicable to the vehicles registered before January 1, 2014.

| Engine Capacity (cc) | Up to 1450 | 1451-1650 | 1651-2050 | 2051-2250 | 2251-2650 | 2651 and more |

| € per cc | €0.04272 | €0.05980 | €0.11960 | €0.14523 | €0.19649 | €0.19649 |

| Cost will be in the range | ||||||

| Private Car | €10-62 | €87-99 | €198-246 | €297-326 | €443-521 | €521 |

| Van | €10-62 | €87-99 | €198-246 | €297-299 | €299 | €299 |

| Commercial vehicles (from 2014 only) | €10-27 | €39-44 | €89-111 | €133-147 | €198-234 | €234-299 |

To calculate the road tax amount for your vehicle, multiply the engine displacement (cc) by the tax rate corresponding to the required category.

For motorcycles with the engine displacement from 1 to 1450 cc, the tax rate is € 0.04272 per cc. These vehicles are categorized as € 10 - € 6

Road tax rates for 2014

The tax rates in 2014 were increased in relation to the rates in force at the end of 2013.

For the vehicles, including motorcycles, the increase was:

- € 12 for the engines up to 2050 cc with CO2 emission levels up to 100 g/km,

- € 22 for the vehicles with higher emissions and engine displacement up to 2050 cc,

- € 32 for the vehicles with the engine volume exceeding 2050 cc.

For the vehicles intended for the carriage of goods with a GVW of up to 3501 kg (i.e. pickup trucks and large vans), the method of calculating the road tax amount has also been changed.

The calculation is made at a price of 0.05 cents per 1 cubic centimeter for the engines with a volume of 1650 cc and at a price of 0.10 cents per cubic centimeter for the engines with a volume of 1651 cc and above, plus a special surcharge, which is individual in each case. The maximum accepted amount is € 299.

Tax rates for the vehicles first registered after January 1, 2014

For the vehicles registered for the first time between January 1, 2014 and December 31, 2018 the amount of road tax is calculated based on the level of carbon dioxide emissions.

Road tax rates for the vehicles registered in Cyprus after January 1, 2014:

- For the vehicles with the emission level of 120 g/km - € 0.5 per gram,

- For the vehicles with the emission level from 121 g/km to 150 g/km - € 3 per gram,

- For the vehicles with the emission level from 151 g/km to 180 g/km - € 3 per gram,

- For the vehicles with the emission level over 180 g/km - € 8 per gram.

Road tax rates for the vehicles first registered in Cyprus after January 1, 2019

On March 15, 2019 Cypriot government passed a Law changing the procedure for levying road tax and excise taxes on new and used imported vehicles. The Law aims to phase out old vehicles from circulation in an attempt to reduce environmental pollution.

The basic principle of the new transport charges is that the higher the level of polluting emissions of this vehicle into the environment, the higher the tax will be paid for a new or imported used vehicle.

From January 1, 2019 excise duties on the vehicles imported to Cyprus have been canceled.

The amount of road tax is determined by two criteria: the level of polluting emissions and the age of the vehicle, which determines the type of its engine and its place in the engine classification system in accordance with the EU standards that determine the permissible emission limits (Euro3, Euro4, Euro5 and Euro6).

Changes in road tax rates from 2019 and the procedure for their application

Road tax has been increased for the passenger vehicles with high CO2 emissions, as well as for newly registered passenger vehicles and vans according to their age.

The cost of the Circulation License for these two categories of vehicles is calculated based on the amount of CO2 emissions (g/km) and constitutes:

| CO2 emission level | Tax rate in € per 1 g of CO2 emission |

| Up to 120 g/km | € 0,5 |

| 121 g/km - 150 g/km | € 3 |

| 151 g/km - 180 g/km | € 6 |

| Over 180 g/km | € 12 |

The cost of an annual Circulation License cannot exceed € 1,500 (maximum tax amount).

| Engine fuel type | Engine fuel type | |

| The service life of the vehicle (calculated from the date of the first registration of the vehicle as new in any country) | Petrol | Diesel |

| Up to 12 months inclusive | not charged | not charged |

| over 12 to 24 months inclusive | € 0 | € 100 |

| over 24 to 36 months inclusive | € 50 | € 100 |

| over 36 to 48 months inclusive | € 100 | € 300 |

| over 48 to 60 months inclusive | € 250 | € 500 |

| over 60 to 96 months inclusive | € 500 | € 1,000 |

| over 96 to 120 months inclusive | € 750 | € 1,500 |

| over 120 months | € 1,000 | € 2,000 |

You can calculate the cost of your car insurance by clicking on the link car insurance.