Tax Calculator for Natural Persons in Cyprus

A tax calculator is based on the following principles:

● The sum of tax reductions (namely, social insurances, savings insurance premiums, GHS - GESY contributions etc.) should not surpass 20% of income.

● In the case of natural persons, savings insurance should come with an obligatory life insurance. As an approximation, the insured capital should be at least 13 times the insurance premium (e.g. if the premium is 10,000, the insured capital should be at least 130,000 euro).

● In case a company is the contracting party, the insured capital can be the minimum amount of €1,000.

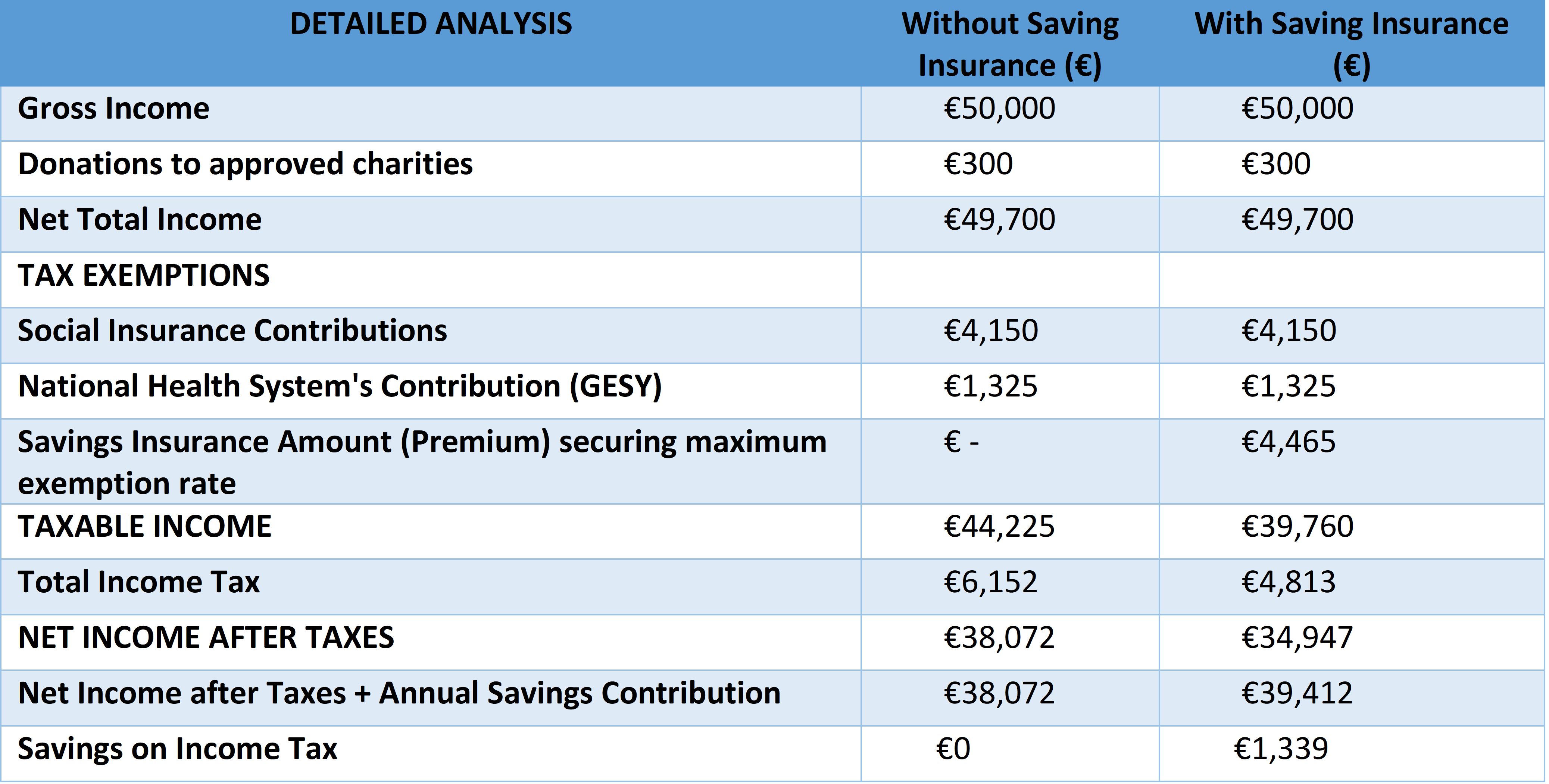

On the second column of the tax calculator, you can see the contracting party’s taxation without savings insurance, while the third column shows the savings amount ensuring maximum tax exemptions.

If we consider an investor with an annual income of €50,000, they will have to pay an annual premium of €4,465 for savings insurance in order to be eligible for the maximum amount of tax exemption. For the contract to be eligible to the tax authorities, a life insurance worth €63,785 needs to be linked to it as well.

Table 1. Example of tax calculation with and without savings insurance