Saving Insurance - Private Pension - Tax Exemptions in Cyprus

1. Introduction

Savings insurance and private pensions are the only non-government saving plans accepted by the Cyprus tax authorities as being valid tax exemptions.

All owners of companies that are tax residents of Cyprus, as well as highly paid employees registered in the Cyprus Social Insurance system, can benefit from the exemptions.

Apart from offering significant tax deductions, a private pension can ensure a lower risk and a higher net return compared to certificates of deposits.

2. Tax Exemptions

The tax authorities in Cyprus exclusively allow for the following as tax exemptions when it comes to natural persons:

- Social Insurances Contributions

- GHS (Gesy) Contributions

- Life Insurances

- Savings Insurances or Private Pensions

- Health Insurance

Under certain terms and conditions, the sum of the above expenses is completely exempted from taxation given that it does not surpass 20% of the gross income (this amount is expected to go up to 25% within 2022).

When it comes to companies, the expenses above are fully accepted as operating expenses, thus contributing to the decrease of the 12.5% corporate tax and the 17% taxation on dividends.

Savings Insurance is also exempted from tax in two other ways, as both its returns and the contract’s redemption value are tax deductible.

These features make Savings Insurances far more enticing than bank deposits.

3. How Savings Insurance Works

Technically speaking, Savings Insurances fall under the broader category of unit-linked funds (i.e. saving and investment units).

Insurance companies create these funds where they gather planholders’ money and subsequently hand over their control to large investment banks (e.g. JP Morgan, Credit Suisse etc.) and investment companies (e.g. Pimco, Vanguard etc.), which are then responsible for investing the sum into a variety of saving and investment products.

Investors are essentially just buying units (shares) of these investment funds, thus giving them the opportunity to invest in a much wider spread of investments than if they were to invest on their own.

The price of the saving units depends on the value of the financial and deposit products the planholders’ money is invested in.

The decision as to which products to invest in depends on the goal of each fund.

The usual goals set by savings funds are divided into three categories:

Conservative (low-risk), moderate (medium-risk) and aggressive (high-risk).

Low-risk funds, which constitute the most popular option out of the three, place investors’ money into certificate of deposits and government bonds with a high solvency rate (>AA+), resulting in minimum fluctuation.

Insurance companies are obliged to update their clients regularly as to both the value of the investment units and the funds’ investment policy, while the same information also needs to be published in private Cyprus newspapers.

For a more analytical presentation of saving and investment funds, you can click here, and if you want to read the terms and conditions of these plans, you can click here.

4. Calculating the ideal savings sum

4.1.Natural Persons

There are two approaches when it comes to determining the ideal savings amount:

● The amount that ensures the same standard of living the entire duration of your life (microeconomic approach).

● The amount that grants you the maximum tax deduction.

4.1.1. First Approach - The Microeconomic Approach

The first approach follows the microeconomic rationale that the average consumer should save approximately 30% of their gross income in order to retain the same standard of living for the entire duration of their life.

To be more specific, 20% of their gross income should be saved for retirement purposes.

Obligatory social insurances in Cyprus ensure 16.6% of that amount. Therefore, a private pension plan should at least get another 3.4% of the gross income put into it (since 20%-16.6% =3.4%)

In our experience, however, public pension funds (sovereign funds) have, on average, a lower return compared to private funds. This happens because their investment policy is not concerned with maximising yields at the lowest risk, but rather with complying with the terms of interstate agreements and political ends.

Keeping that into consideration, the ideal private retirement sum is suggested to be closer to 5% of the gross income.

4.1.2. Second Approach - The sum ensuring maximum tax deduction

Income tax in Cyprus

The second approach is one of determining the savings amount that will ensure the biggest possible tax deduction.

This is naturally a more complex process, since it incorporates all the restrictions set by the tax legislation for natural persons.

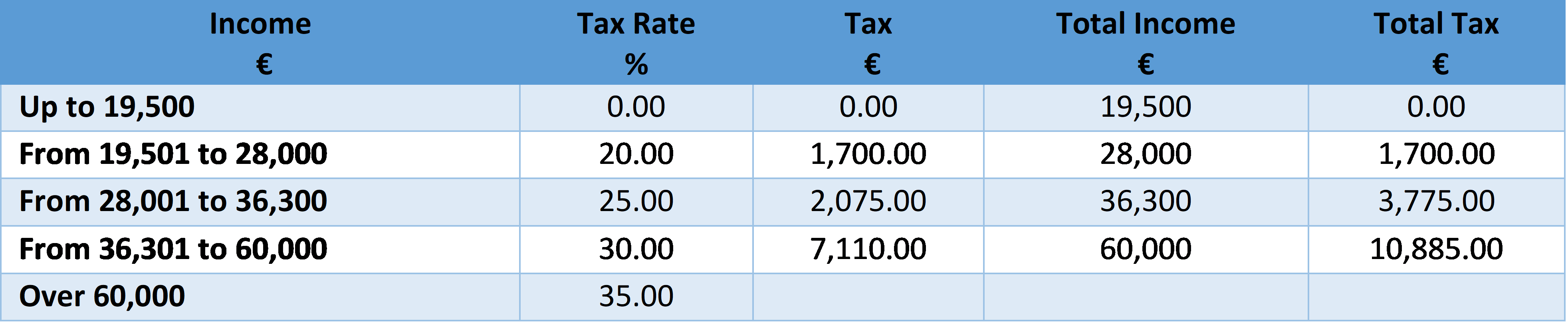

As can be seen in the table below, Cyprus has a progressive taxation system in place. More specifically, all income is subject to a tax rate of 20%-35%.

Table 1 - Income Tax in Cyprus - Taxable Income Bands

A savings insurance plan is the only private savings product that allows for a deduction on this tax.

Tax Calculator

A tax calculator is a tool that allows the taxed citizen to calculate the amount of tax they are currently subject to, as well as to see how that tax can be reduced via a savings insurance plan.

For example, an investor that has an annual income of 50,000 euros can see that the best amount to save per month is 372 euro, which will also allow for an annual tax deduction of 1,339 euro.

To check out how savings insurance can reduce your taxes, you can use the link here.

To read more on how a tax calculator works, you can click here.

4.2. Companies

For legal entities, tax exemptions can be calculated much faster.

Savings insurance is considered a company’s operating expense and is tax-deductible.

Savings Insurance always reduces corporate tax based on the equation:

Tax Savings = Savings Insurance x Corporate Tax Percentage (12.5%)

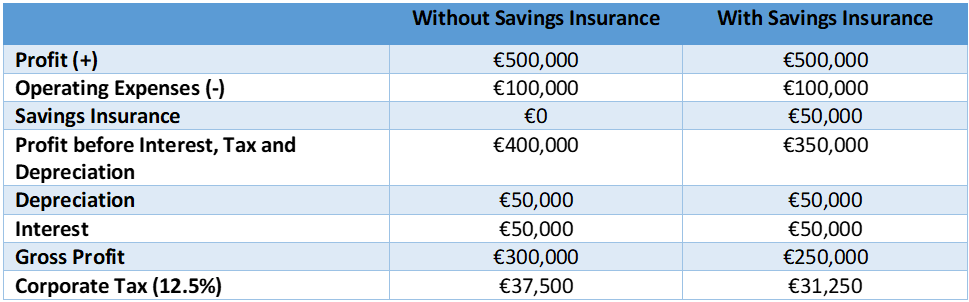

The table below shows a simplified version of a company’s profit and loss after its directors decide on getting a savings insurance worth 50,000 euro.

Table 2 - Example of Income Tax with and without Savings Insurance.

As can be seen on the table, savings insurance decreases tax by 16% (from €37,500 to €31,250).

Tax savings can also be calculated using the same equation as before:

Tax savings = 50,000 x 12.5% = €6,250

The benefits are even greater if the company directors also pay dividend tax, since the sum of the savings insurance is also protected by the 17% dividend tax.

Savings insurance also gives directors-shareholders of companies the chance to reduce the salary amount they declare to social insurances, which historically have always offered a much lower yield compared to private pensions.

In other words, directors can declare a much lower salary than what they actually get, transfer that money to their savings insurance plans and then liquify their capital as tax-free private pensions with a much higher yield than is currently offered by public ones.

5. Group Savings Insurance and Private Pensions

In Cyprus, there is no legal framework to allow for group pension or savings plans for companies yet.

Nevertheless, several companies have already begun offering private savings programs, which effectively function as private pensions, to their employees.

The difference between these plans and public pensions is that a pension is given as a lump-sum at retirement age. Monthly private pensions, also known as annuities, are not expected to be adopted in Cyprus at least until 2024.

Savings insurance plans are much more flexible than the forthcoming monthly pensions, since they offer a chance for partial liquidation of the contract’s redemption value, or even its entire redemption value, before reaching the age of retirement.

With group private pensions, investors will not be able to access their capital before the age of retirement.

For more information regarding private pensions, you can read the article here.

6. Benefits and Drawbacks of Savings Insurance

Savings insurance plans and private pensions have become particularly popular in Cyprus after 2015.

Based on statistics by the Superintendent of Insurance in Cyprus, over 65% of professionals with an income of over 40,000 euro have some sort of a savings plan (March 2022).

The main advantages of these products are:

- Prudent and highly professional management

- Discipline when it comes to saving for a long-term goal

- Flexibility and ability to have immediate liquidation

- Tax deductions

On the other hand, saving via these products should always be done under the guidance of professional investment advisors, due to certain risks that may arise.

Indicatively, the most significant risks are:

- Market risk

- Capital consolidation risk

- Liquidation/Settlement risk

- Inflation risk

If you want to find out about the benefits and risks of these plans, you can read the article here.

For advice on issues related to saving insurance and private pension plans, you can contact the specialists of our company by e-mail: [email protected]

Director Pitsas Insurances

June 2022

Limassol, Cyprus