Terms and Conditions of Savings Insurance - Private Pensions in Cyprus

The main terms and conditions of savings insurance plans are mentioned below in brief.

The main terms and conditions of savings insurance plans are mentioned below in brief.

1.The minimum insurance premium is 35 euro on a monthly basis and the minimum insured capital is €1,000.

2.In case the company is insured, the contract has €1,000 as the minimum insured capital amount.

3.Savings insurance can be paid annually (via bank transfer) or on a monthly basis using direct debit.

4.The maximum age acceptable for signing a contract is 70.

5.In the case of the insured person’s death, the amount payable will be the one that is the highest between the insured capital and the contract’s redemption value. For example, if life insurance is 75,000 euro and the contract has a redemption value of 25,000 euro, the insured’s beneficiaries will get the amount of 75,000 euro exclusively.

6.The savings insurance contribution can increase on every anniversary of payment.

7.The money can be placed in more than one funds, making it possible for a fund combination to be created.

8.There can be four (4) changes of fund combinations every year. The first change is free of charge, the rest are charged €20 each.

9.The insurance premium can change (decrease or increase) under conditions, after the predetermined insurance premium has been paid in full for a year.

10.You have the right to a lump-sum from the first day of the contract’s issuance, with the minimum amount of payment being €1,000.

11.Policy fees: €60 annually (automatically deducted from contributions).

12.The ask-bid price equals 5% of the value of the saving units under liquidation.

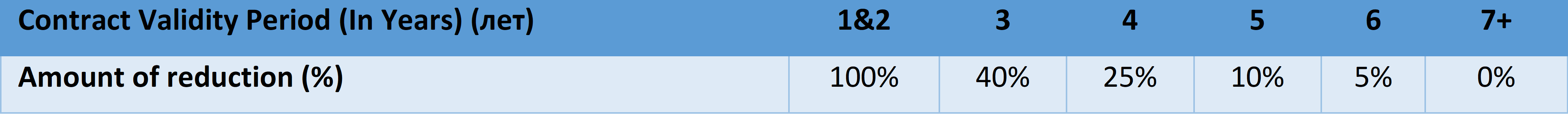

13.How the fund value decreases in case of redemption, in percentages:

14.There is a possibility for a partial redemption of up to 50% of the redemption value.

14.There is a possibility for a partial redemption of up to 50% of the redemption value.

15.The minimum value after a partial redemption needs to be higher than €1,200.

16.Partial redemption means an equal reduction in the basic death coverage.

17.Variable charge: 0.5% on the fund value for the contract’s entire validity period.

18.Management fees: 0.8 - 1.5% on the fund’s value. Conservative funds have the lowest management fees (0.8%), whereas aggressive ones have the highest (1.5%).