Provident Funds in Cyprus in 2025. A complete guide.

What is a provident fund in Cyprus?

What is a provident fund in Cyprus?

A provident fund is essentially a private group pension plan that some employers provide for their employees in Cyprus.

Provident fund members invest monthly a fixed percentage of their salary into a common investment pool for their retirement in much the same way as they would with social insurances.

The ageing population and the Cypriot economy’s slow development rates for over a decade have put the social security system into a challenging situation.

Through the introduction of provident funds legislation, the Cypriot government has incentivised employers to create private pension funds, providing generous tax exemptions.

In this analytical guide to Provident Fund Cyprus, we will present provident funds and examples of how they reduce the amount of an individual’s taxable income. In addition, we will discuss the following topics:

Table of contents

- How does a provident fund work in Cyprus?

- Provident fund Cyprus law

- Cyprus provident fund characteristics

- Taxation of provident funds Cyprus

- Provident Fund Management Fees

- How secure are provident funds in Cyprus?

- Provident funds for small companies Cyprus

- How long does provident fund pay out?

- Can I cash out my provident fund?

- How to get provident funds in Cyprus

How does a provident fund work in Cyprus?

In Cyprus, a provident fund is managed by a licensed pension provider.

The pension providers are typically either insurance companies or asset management companies.

The operation of a provident fund involves contributions from both the employee and the employer, similar to social security contributions. The amounts contributed by each party can either be indentical or differ. For example the employer can contribute 5% and the employee 4% on the employee's gross salary.

The employer usually sets the contribution amount and provides these details in an employment contract.

The provident fund providers in Cyprus sometimes have a prerequisite outlining the minimum number of employees they accept under one provident fund scheme.

Employees are generally restricted from accessing their pension funds, before reaching their retirement age or unless their employment is terminated. However, it is permissible for the employee to borrow a portion of their funds.

By law, provident funds (and their managers) are under an obligation to fulfil the following:

- To carry out their own risk assessment.

- Contain an internal audit control feature.

- Have an investment strategy and a detailed statement in the investment policy.

- Form an administrative committee who have the necessary qualifications for the work.

- The administrative committee’s remuneration policy must be provided to the Cypriot Registrar of Provident Funds.

Provident fund Cyprus law

The current provident fund law is known as "10(Ι)/2020".

Re. The Establishment of the Activities and Supervision of the Institutions of Professional Retirement Benefits.

Published in February 2020, Cypriot Law "10(I)/2020" and the above act fortified the regulation of occupational pension funds by introducing further responsibility and authoritative command for supervisory authorities.

You can read the new law (available only in Greek) on the following link.

Published in July 2021, secondary legislation to the above covers transferring a private provident fund to one of a multi-employer "325/ 2021" or insurance class 7 "326/ 2021" and enables the transfer of an individual member’s account to an employer’s chosen pension provider.

An older version of the law known as "208(Ι)/2012" essentially bonds the previous legislation, "L. 44/ 1981" and "L. 146/ 2006", and their related amendments.

You can view that law (provided exclusively in Greek) on the following link.

The managers of provident funds and pension funds in Cyprus must comply with the new law and be aware of any updates and changes, as their plans may require amendments.

One of the most significant changes in the new legislation is the obligation to restrict the “vesting period” (i.e. ownership period) to a four-year maximum.

In practical terms, all provident fund members with over four years of service to a company are eligible to receive 100% of the employer’s contributions.

This law is not to be mistaken for the “Management of Group Pension Funds” law, governed by Class VII of the Insurance and Reinsurance Services, and other related issues "38(1)/2016".

Cyprus provident fund characteristics

Reliable investment funds

Provident fund insurance companies provide a wide array of investment funds from which an investor can choose.

You can read our article here for more information about the characteristics of pension funds provided in Cyprus.

Independent portfolio management strategy

An employee can decide their personal investment strategy in accordance with their risk profile.

Investors who are risk averse can choose to place their earnings in funds that invest in money funds, government bonds, and certificates of deposits.

Investors who are able to afford the risk can invest their money in stocks, corporate bonds, and bonds of developing countries.

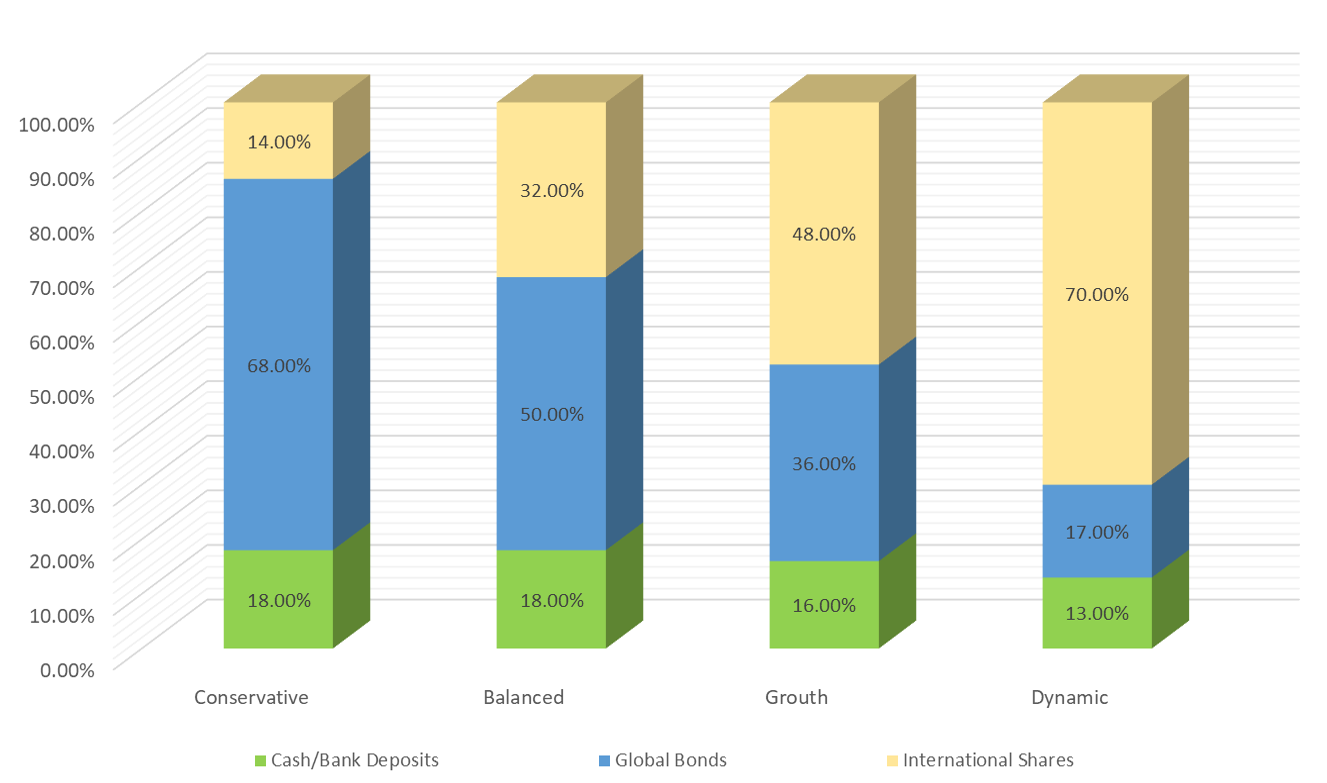

The graph below shows an example of the investment strategies provided by the standard pension funds in Cyprus.

Members can switch between saving funds during the year. The most flexible provident fund providers in Cyprus give the opportunity to change investment strategy once per week without any charge.

Transparency

Members of a fund can check their balances online through online platforms or mobile applications.

The values of the saving funds are usually updated on a weekly basis.

The most transparent provident fund providers in Cyprus also disclose to their members their exact investment positions, i.e. in which funds (ETFs, UCITs) they invest.

Management fees

Like all investment funds, provident funds charge management fees. We analyse this topic in more detail below.

Provident fund administration committee

As mentioned earlier, all provident funds must be run by a registered committee and a licensed fund manager (i.e. insurance company or asset managers).

Provident funds provided by insurance companies are not obliged to follow this rule since the insurance company carries out its own regulatory duties.

Taxation of provident funds Cyprus

Both employer and employee receive sizable tax benefits through a Cyprus provident fund.

- Employer’s tax-deductible contributions: up to 10% of each member’s taxable income.

- Employee’s tax-deductible contributions: up to 10% of their annual income.

- Any provident fund interests are subject to Special Contribution for Defence: 3%.

- Any payment to provident funds (capital sums) is fully tax-exempted from income tax.

Provident Funds and Income Tax

The percentage of employees’ taxable income in Cyprus that can be exempted from taxation is currently 20%. This percentage is predicted to rise to 25% in 2024.

Employees’ eligible expenses for tax exemptions are:

- Contributions to the general health system and social insurance.

- 1.5% maximum of salary: private medical insurance premiums.

- 7% maximum of the death benefit: life insurance premiums.

- 10% maximum of salary: pension and provident fund contributions.

Here’s a simplified example of an individual’s contributions and exemptions to analyse how provident fund contributions reduce income tax.

We will examine an employee with the following characteristics:

| Salary | €70,000 |

| Social Insurance contributions | €4,500 |

| General health system contributions | €2,000 |

| Life insurance annual premiums | €2,500 (they are fully tax exempted if the death benefit is more than €36,000). |

The employee’s total income is €70,000 with no other income sources (i.e. rents).

Eligible Expenses for Tax Exemptions = general health system contributions + social insurance contributions + life insurance annual premiums = €2,000 + €4,500 + €2,500 = €9,000.

Eligible tax exemptions limit: 20% of the employer’s net income: €70,000 = €14,000.

Then, the limit of eligible tax exemptions minus the expenses eligible for tax exemptions = €14,000 - €9,000 = €5,000.

Practically speaking, €5,000 can be used for provident funds if this amount does not exceed 10% of the employee’s salary.

10% of the employee’s €70,000 salary is €7,000 which is above €5,000. Therefore, €5,000 can be fully used for tax exemptions.

Therefore the total exemptions that can be deducted from the applicant’s income is:

General Health System + Social Insurance Contributions + Life Insurance Premiums (limited to 7% of the insured amount) + Provident Fund = €2,000 + €4,500 + €2,500 + €5,000 = €14,000.

Effectively, the employee’s taxable income is €70,000 - €14,000 = €56,000.

Provident Fund management fees

The provident fund management fees are classified into the following categories:

- Annual Fees

- Transaction Fees or One-Time fees

The breakdown of the annual fees is:

- Administration or/and maintenance fees

- Direct Fees

- Third party fees

The usual transaction fees or one-time fees are:

- Set-up fees

- Termination fees

- Transfer fees (when the employee transfers their plan to another provider)

- Change of investment fund strategy fees

- Addition or removal of members fees

- Bid-ask fees, applicable when liquidating funds for borrowing purposes

Most provident fund providers in Cyprus do not charge administration/maintenance and one-time fees. They just charge direct fees and third-party fees.

The lowest fees you should expect from provident funds in Cyprus are given in the table below

| Types of Funds | Direct Fees | 3rd Party Fees | Total Expense Ratio |

| Passive Funds | 0.4% | 0% | 0.4% |

| Active Funds | 1% | 0.25% | 1.25% |

Third-party fees typically include fund management fees charged by 3rd party asset managers. Also, they include fees related with custodian services and trading fees.

How secure are provident funds in Cyprus?

Provident funds are relatively secure, but they are investments, so they are not without risk.

Like all funds, provident funds are subject to the following risks:

- Inflation

- Market risks

- Frozen assets

- Bankruptcy (e.g. an investment organisation).

For a more analytical presentation of these benefits and risks, read our article here.

The Solvency II ratio is the most reliable indicator when comparing the trustworthiness of insurance companies that offer provident funds.

The higher the Solvency II ratio the lower the debt ratio, enhancing the insurance company's ability to offer substantial protection to the members of the provident funds.

The most reliable provident fund providers in Cyprus have Solvency II ratio higher than 200%.

Provident funds for small companies Cyprus

Small companies can’t apply for provident funds due to the requirement for a minimum number of employees on one scheme.

In this case, there are flexible individual pension programs that individuals can acquire.

For more information about independent pension programs, see our article here.

How long does provident fund pay out?

Provident funds can only be cashed out during the pension age, but you can borrow money from your provident fund.

Other than that, if you leave the company and your new company does not have a pension fund, you may also cash out your pension.

If flexibility is a priority for you (i.e. the ability to cash out part of your savings without any penalties or obligation to return borrowed funds), consider private pension funds.

Provident Fund Cyprus

See our article here about private pension funds for more information.

Can I cash out my provident fund?

In general, you cannot withdraw capitals from your provident fund before reaching your retirement age.

However, you are allowed to borrow money from your provident fund for the following reasons:

- To cover expenses related to medical issues or critical illnesses (e.g., cancer)

- For the acquisition, renovation, or extension of your primary residence

- For children's education

In addition, you can cash out part of your provident fund capitals as a loan.

The most common terms of this type of loan are:

- The minimum interest rate for borrowing from your fund is 2% annually.

- The employee's withdrawal cannot exceed 45% of the accumulated balance.

- The loan period cannot extend beyond 20 years or up to the member's retirement date, whichever comes first.

If your employment is terminated, you are given three options:

- You can fully withdraw your provident fund.

- If your new employer offers a provident fund, you can transfer the redemption value to this new fund.

- You can transfer your provident fund to an individual pension plan with similar characteristics.

Additionally, in the event of permanent disability preventing work, the employee also has access to his provident fund capitals.

Best Provident Funds in Cyprus

When choosing a pension fund, consider the following aspects

(1) Trustworthiness of the provider

- The main providers of pension funds in Cyprus are insurance companies. The financial health and robustness of an insurance company are measured by a ratio called Solvency II.

- The higher the Solvency II ratio of an insurance company, the more reliable the provider is.

- Ideally, choose an insurance provider with a Solvency II ratio higher than 200%.

(2) Transparency

- Digital tools significantly impact the selection of a provider. Not all providers offer easy online tools to track the value of your pension savings.

- Not all providers disclose the positions (i.e., the funds) they invest in. Some only show the allocation among different asset classes (e.g., shares, bonds) but not the specific funds.

- Choose a provider that offers tools to track the performance of your funds.

(3) Investment Versatility

- Not all providers allow you to switch freely and quickly between funds.

- Some providers offer the option to switch up to 52 times per year among funds.

(4) Management Fees

Management fees are crucial when selecting a provider.

The best provident funds in Cyprus charge only direct fees and third-party fees.

The core of management fees comprises direct fees and third-party fees, summed up as the Total Expense Ratio (TER):

TER = Direct Fees + Third-Party Fees

The best provident funds in Cyprus charge the following TER, depending on the type of fund management:

- Active funds: 1.3%

- Passive funds: 0.45%

(5) Easy addition and Removal of Employees

Employers should be able to easily add or remove an employee from the program without excessive paperwork.

(6) Borrowing from Your Account

All pension funds provide the opportunity to borrow from your redemption values at a standard interest rate of 2% annually.

How to get provident funds in Cyprus

As noted in this Provident Fund Cyprus guide, licensed insurance companies in Cyprus provide provident funds.

To be precise, these insurance providers offer individual and group investment plans and savings.

Communicate with one of our insurance specialists if you need more guidance about Provident Fund Cyprus, and speak with us about your insurance options.

Pitsas Insurance is the largest provider of business insurance products in Cyprus:

- Group Health Insurance

- Group Life Insurance

- Professional Indemnity Insurance

- Directors & Officers Insurance

- Cyber Insurance

- Business Insurance

- Employers Liability Insurance

- General Public Liability Insurance

Pitsas Insurance Team